Romney's tax return has become an issue. The charge that may have committed a felony by retroactively retiring form a company that he continued working for at the time, and thus made conflict of interest, hasn't escaped the notice of either his enemies or his friends. Both side urge him to resale his tax returns.

What about the way taxes figure into the campaign as an issue? The Obama campaign outlines their position thus:

Info please

Romney Campaign (Ibid)Budget/Deficit/Taxes

- Will focus on continuing to stimulate the economy by creating new jobs and investing in health care, education, energy, and infrastructure

- Increase alternative energy production, modernize and weatherize buildings and homes, expand broadband technology, and computerize the health care system. Obama has said these measures will create some 3.5 million jobs

- Supports the Making Home Affordable Modification program to prevent foreclosures and the Making Home Affordable Refinancing program to restructure loans to keep people in their homes

- Has demanded accountability and transparency from banks and other financial institutions

- Plans to create a financial regulatory system that makes executives in the financial market accountable for their actions and prevents fraud

- Will work to make the tax system more fair to working families and the middle class and eliminate loopholes that benefit the wealthy

- Has promised to simplify the tax code

Granted this is the public face each side puts on so the voter will get an idealized view of them in their sundae best all clean and antiseptic so one might vote for them.Budget/Deficit/Taxes

- Criticizes the Obama spending bill, saying it will only stimulate the government, not the economy.

- Believes a well-crafted stimulus plan is needed to put people back to work and that permanent tax cuts should be at the center of the stimulus plan.

- Believes in the principle behind Reaganomics: cutting taxes brings economic growth.

- Supports a budget that cuts payroll taxes for people aged sixty-five and older as well as cutting taxes on people earning less than $200,000 a year, including reducing taxes on savings and investment.

- Supports a national catastrophic fund to cover home owners insurance in the event of natural disasters like hurricanes and tornadoes.

- Opposes the estate tax.

- Believes only private sector entrepreneurs will create the millions of jobs that the U.S. needs.

- Endorses eliminating the minimum wage.

- For placing sanctions on China.

- Wants to cut the corporate tax rate.

What's the real difference? Obama wants to use taxes structures to stimulate the economy but Romney claims this will only help government. The Republicans argue that private sector is more productive and doesn't evoke huge government spending. When Republicans have given their blessing to tax cuts for private industry the private industry doesn't spend the money on labor intensive projects. When Reagan made tax cuts so the steel industry would modernize they invested in oil and other less labor intensive things and did not modernize their industry and we continued to decay into the rust belt and couldn't compete in steel. (see also)

Populist Daily

Sat July 21,2012

Ronald Reagan cut taxes in the belief that doing so would stimulate the economy several times more than the cost of the tax cuts. It is something like this (and it sounds…sounds…logical): if we cut the amount of money you pay to the government (taxes) then you will have more to spend. The more you make, the more you save in taxes and the more you have to spend or invest. More spending and investment will boost the economy several times more than the cost of those tax cuts to the government.

Well, it sounds great but we all know now that it did not work. Studies by the Congressional Budget Office showed that the most that the government (that is, us taxpayers) could expect to get back in return was about 20% of the money that the government lost.

The result of those mixed up economics was a continuing deficit of hundreds of billions of dollars a year up until Bill Clinton was able to stem it and balance the budget in the last three years of his eight years as President. But by then the national debt was $5.6 trillion dollars! Then, George W. Bush and Dick Cheney took it to $12 trillion in just 8 years, relying on the advice of the same economists who had incorrectly guided Reagan and Bush’s father.

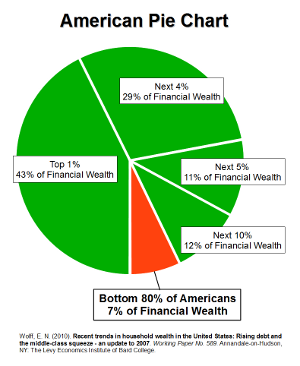

American productivity has continued to rise but the American middle class has not benefited from it.

While some think "if public sector stimulates works why didn't the stimulus package do any good?" Why did the economy continue down hill? It's been reported that the stimulus package did create a couple of million jobs. The problem we continued to lose more than that. Things would have been much worse without the package, it's hard to see that because they they still got bad. It would have been much worse without it.

If you look at Rowney's no 2 point you see it reads basically like Obama's no 1. Neither list is really is saying anything at that point. What are they calling "well crafted?"

Obama wants to extend Bush Tax cuts to middle class and not the super rich.

CNN Politics

July 9, 2012

A Romney Campaign official is quoted as saying:Washington (CNN) -- President Barack Obama revitalized his push for holding down middle-class tax rates Monday, calling on Congress to pass a one-year extension of the Bush-era tax cuts for people earning less than $250,000 a year.

In a White House statement delivered while people described as working Americans stood behind him, Obama said his proposal would provide the certainty of no tax increase next year for 98% of Americans.

Noting that Republicans seek to maintain all of the Bush tax cuts enacted in 2001 and 2003, Obama said both sides therefore agree on extending the lower rates for middle-class families.

Don't raise taxes on anyone is the Republican euphemism for "let the 1% get richer." This relates back to what we said above. They want you to believe that if they don't tax the rich the rich will spend the money on labor intesive probject and crate jobs. They constantly speak as though right wing rich guys know all about job creation. As we have seen what really happens is they invest the money overseas where it doesn't create American jobs."President Obama's response to even more bad economic news is a massive tax increase," said Andrea Saul, the Romney campaign's spokeswoman. "It just proves again that the president doesn't have a clue how to get America working again and help the middle class."

Unlike Obama, Saul continued, Romney "understands that the last thing we need to do in this economy is raise taxes on anyone." (ibid)

The republicans charge that Obama's tax program will harm small businesses the truth is "Obama, however, said that under his proposal, 97% of the nation's small business owners would benefit from having their lower tax rates maintained at current levels.'This isn't about taxing job creators," Obama said. "This is about helping job creators.'" (ibid)

No comments:

Post a Comment