A book by Joan Walsh. This is an excellent book. Walsh argues that government action built the American middle class in the years after world war II. The things government did to create a strong middle were not available to blacks and Hispanics, until the social action of the 60's opened them up to minorities through the civil rights act. From that point on the Republican propaganda merchants begin selling the white middle class on a mythical golden age and feeding them the line they did it all themselves by their own worthiness as superior people. They totally forgot about the G.I. Bill, legislation that fair housing possible controlled lending, created cheap housing for middle class families, medicare which freed people from huge expense being wiped by illness in their "golden years."

Walsh, who is white, daughter of a Steam Fitter and union man, traces the rise of the American middle class from the New deal. Republicans in the Reagan era spread about the myth that Roosevelt didn't do anything. By the time that happened most of the old Roosevelt supporters and the adults of the depression who weathered the storm and aw what he did for them, were old and dying and not longer taken seriously by their children. So no on Remembers what Roosevelt did. The New deal a life saver for millions of people. It put the country back to work at a time when unemployment was 30% (we think we have trouble when it's at 8%--it just fell below 8% but no one cares). Even before the new deal American society was a fudealistic culture with the Rich ruling like monarchs in an unoficial capacity and whole states living in darkness with no electricity. Rural electrification was one of the major things that created the middle class, it gave people lights and telephone labor saving devices like washing machines. The old rich monarch of the community is seen, although most people probably don't know it, in the character of Mr. Burns on the Simpsons who is patterned after characters on Orson Well's film "the Magnificent Ambersons." (see about novel) The joke is Burns is so old he's a hold over from a past age int eh 19th century; the old money families are still in charge, as robber barons they ran coal mines, how they run the nuclear power plant.

The Tennessee valley authority is an example of the kind of government help that got the American middle class on its feet. This problem would be called "socialism" by tea party types it's what up American into the 20th century. About the time programs like fair housing started being administered to minorities, Republican pitch began laying the ground work for the Reagan era by spinning myths of a golden age when conservative Christianity was the norm and everyone was a republican and all white Americans pulled themselves up by their own boot straps. That was the major propaganda line for Reagan. The "America is Back" theme harkened unto that non existent golden age. On Tavis Smiley (the dreaded PBS) Walsh talked about how modern conservatives will speak of "getting government out of medicare" as though medicare is not a government program or an entitlement. It is both. It was major thing that made economic independence of the middle class possible.

SF GATE: Book Review

'What's the Matter With White People?'Joel Whitney

Updated 3:16 a.m., Monday, August 27, 2012

Reagan wielded the phrase "welfare queens," and pushed a false view that most recipients were black, lazy and happy not to work. This helped galvanize a false sense among working-class whites that they themselves had never received government help on their way to the middle class. "I once blamed the conflict solely on wealthy capitalists and their politician-servants such as Nixon and [Pat] Buchanan," Walsh writes, "pitting the two groups at the bottom against each other." No more. Her own side, including the race-obsessed left, played, and plays, into this.

In a sense, Walsh sees herself taking up the actual "sweet, reasonable middle." She describes a whiplash, "one day calling out the racism of the president's worst critics, the next day being accused of racial bias by Obama's defenders if I described his disturbingly centrist political maneuvering."Read more: http://www.sfgate.com/books/article/What-s-the-Matter-With-White-People-3814027.php#ixzz28tFiQBzM

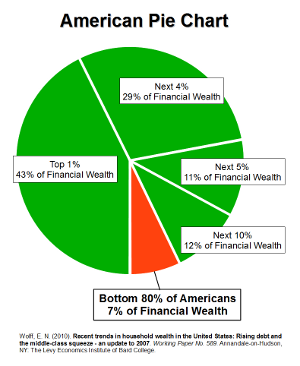

Now the myth is that government is always bad, it's destroyed our way of life. what's destroyed the prospects of the middle class is Bush's policies, before him Reaganomics. The Republicans billed the poor "a special interest" while maintaining that the true special interstates (the 1%) are escaping the rising tide of taxes on the middle class. The label democrats "tax and spend" while they themselves are the one's whose tax cuts were primarily for the rich. Rowney's policies put the tax burden squarely on the backs of the middle class while allowing the rich to escape. Obama's tax policy would give the middle class the break and put the burden on the 1% who have 90% of the wealth and don't pay taxes. While middle class feels ignored because Republican rhetoric has made them feel that regulation is to blame for all their problems. It was the destruction of regulation that allowed the near economic collapse at the end of the Bush years, the need for the big bail out of banks. Despite what Romney said in the debate he had campaigned all along on a formula of decreasing revenue and cutting social program (such as medicare which he would replace with a voucher system). So he's just continuing the policies and the myth of the golden age and the self reliant self made boot strap white people who never had relied on government and are now oppressed by too much government. what they really mean by "too much government" but less protection from rip off and more burden on the middle class, few social programs.

Walsh's book is also a personal memoir of her family. I traces where they came from and what they've been through. This helps the reader relate and to puts our own experiences and our own family histories into focus.

______

I looked up "what was he accomplishment of the new deal on Yahoo just to see what the popular misconception is:

best answer chosen by voters

The purpose was to give the economy a boost. It's major accomplishment though was to keep us stuck in the Great Depression for years longer while the rest of the world was already recovering and out of their depressions.They didn't create any jobs and it was the New Deal that kept us in the depression. those who lived through unanimous to the least 1% new it saved their lives. The know nothing doesn't even realize the rest of the world was coming out of it because they were trying similar things to the new deal.

Primarily, it tried to put unemployed people to work rather than creating jobs for them to get. The difference being that the jobs created by the New Deal were similar to paying some homeless guy to clean your dining table. Sure it's a nice gesture to help out that person, but it's not any sort of real job that impacts the economy. All it does is end up keeping millions of people dependent on the government so they can keep their pseudo-job since no one else would pay them to do that job.

The New deal created millions of jobs. So that perception of it is a total lie. one can find it being taught in economists class all over the country.